Gambling Winnings Reporting Requirements

Gambling is a $140 billion per year industry. Although the consumer electronics industry is larger ($186.4 billion), the gambling industry is larger than the cable TV ($97.6 billion), outdoor equipment ($11 billion), U.S. box office ($10.2 billion), and U.S. music ($7.0 billion) industries combined. As a matter of fact, in the twenty years from 1991 to 2011, consumer spending on commercial casino gaming grew from $8.6 billion to $35.6 billion—an increase of 314 percent!

Winnings in the following amounts must be reported to the IRS by the payer: $600 or more at a horse track (if that is 300 times your bet) $1,200 or more at a slot machine or bingo game $1,500 or more in keno winnings.

- Gambling winnings, just like any other income, are taxed in the United States. If you raked in gold last year for sports betting, keep reading. In this post, we discuss everything you need to know about paying tax on sports betting.

- The IRS isn’t leaving gambling reporting to chance. It has issued new final regulations clarifying and expanding the rules for payors of slot, bingo and keno winnings. Most notably, in response.

- Unreported Gambling Earnings and Tax Reporting. Unreported Gambling Earnings & U.S. Tax: Maybe you are at the track watching horse racing with your grandparents (those were good times), or in Vegas at the Caesar’s Palace — and you strike it big! Over the course of the weekend, you were able to win $50,000 in gambling winnings.

With such a dramatic increase in gambling activity in the United States, gambling reporting has also increased. But exactly how to report this activity can be confusing.

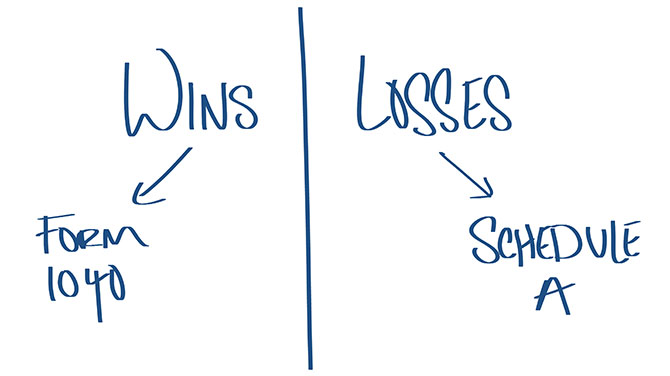

And unfortunately, the seventeen words of IRC Sec. 165(d) provide little guidance on the reporting requirements of wagering gains and losses. (Footnote 1) The IRS instructions say little more than “gambling income” shall be reported as “other income” on IRS Form 1040 (Footnote 2), and if a taxpayer elects to itemize his or her deductions, then “gambling losses” are included on Schedule A (Itemized Deductions) as “other miscellaneous deductions not subject to the 2 percent limitation” but only up to the amount of winnings. (Footnote 3)

To further complicate matters, the IRS computer matching program, which makes sure that a taxpayer includes all of his gambling winnings reported on Form-W2Gs, completely ignores the IRS-preferred and Tax Court-approved methodology of gambling sessions. This inconsistency is also repeated by every tax software package that the author has personally reviewed.

It should come as no surprise then that with such vague instructions, it is likely that the vast majority of tax returns that report gambling income—whether prepared by the taxpayer, a tax professional, or tax software— are prepared incorrectly. This article will provide a step-by-step guide for the proper treatment of gambling income.

Step 1: Include All Wagering Gains in Gross Income

Gross income is defined very broadly. It includes “all income from whatever source derived, except as otherwise provided by law” (Footnote 4), and there is no legislative exception for gambling income. (Footnote 5) Moreover, “It is held that for federal income tax purposes, all wagering gains must be clearly included in gross income” [Emphasis added]. (Footnote 6) The U.S. Supreme Court, the U.S. Tax Court, the U. S. Court of Claims, the U.S. Courts of Appeals, and numerous U.S. district courts have examined this issue and reached the same conclusion—gambling income will be included in gross income. (Footnote 7)

Unfortunately, many taxpayers and tax professionals mistakenly rely upon myth, urban legend, or just bad information when deciding what to include. For example, Gary Bauman mistakenly believed that he was not required to report his $73,733 jackpot because he qualified for a Social Security disability pension. (Footnote 8)

Another common myth suggests that only amounts reported to the IRS on Form W-2Gs should be included. This is obviously incorrect. It does not matter if the wagering gains are won on a cruise ship in international waters or in a foreign country; the amounts need to be included. If an individual has wagering gains from an Internet website, the amounts need to be included. If the wagering gains are from friendly wagers or from a March Madness office pool, the amounts need to be included. If a taxpayer has wagering gains below the Form W-2G reporting thresholds, a very common scenario, the wagering gains still need to be included.

The IRS and judges get suspicious if the amount of gambling income reported by a taxpayer exactly matches the total amount of gambling income reported on Form W-2Gs.On audit, the IRS is more likely to demand that a taxpayer substantiate his or her gambling losses. In like manner, the courts require something more than the (possibly) self-serving oral testimony of the taxpayer As evidence of gambling losses. In several reported cases, the courts suspected that the taxpayers had more gambling income than what was reported to the IRS by the casinos on the Form W-2Gs. As a makeshift form of King Solomon’s splitting-the-baby wisdom, the courts reasoned that their disallowance of the taxpayer’s gambling losses sufficiently offset the taxpayer’s underreported gambling income. (Footnote 9) Either course of action is frequently to the detriment of the taxpayer. Simply put, all means all.

Step 2: Exclude the Basis of the Wagering Gains

Rev. Rul. 83-103, 1983-2 C.B. 148, provides that the “basis” of a wager is excluded from the amount of a “wagering gain.” For example, if a taxpayer purchased a $20 lottery ticket that ultimately won $1 million, then his wagering gain is $999,980 and not $1 million.This step is frequently overlooked or mistakenly included as part of the calculation for wagering losses.

Step 3: Organize and Compute Wagering Transactions by Gambling Session

It is important to recognize that the focus of IRC Sec. 165(d) is on wagering transactions and not on wagering as an activity. Th is is why taxpayers are not allowed to simply net together their total gains and losses for the year and report the difference or rely upon win/loss statements from casinos. (Footnote 10) If such a “netting” methodology is discovered, the IRS and courts consistently force the taxpayer to “un-net” the wins and losses and recalculate the return accordingly. Please be aware that a sampling of such cases shows that the IRS is willing to litigate this issue over relatively small amounts. (Footnote 11)

With this zealous emphasis on transactions, the courts recognized early on that it was impractical for a taxpayer to report every single roll of the dice, pull of a slot machine handle, draw of a card, or spin of the wheel. (Footnote 12) As a result, a bright-line test was devised. A taxpayer’s “accession to wealth” (i.e. wagering gain or loss) is determined when the taxpayer stops gambling. (Footnote 13) Th us, the concept of a “gambling session” was born.

In general, a gambling session is comprised of three unique components—time, place, and activity. By way of example, a taxpayer who gambles at two

different casinos on the same day would have at least two gambling sessions (different places). A taxpayer who played slot machines and black jack on the same day at the same casino would have at least two gambling sessions (different activities). A taxpayer who played slot machines over three days would have at least three gambling sessions (different times). But by comparison, a taxpayer involved in a three-day poker tournament would have only one gambling session since any accession to wealth cannot be determined until the tournament is finished and the final payouts to the participants are calculated and made.

In 2008, the IRS attempted to summarize the gambling-session doctrine in Chief Counsel Advice Memorandum 2008-011, “Reporting of Wagering Gains and Losses” (CCAM 2008-011). Several recent private telephone calls with IRS employees by the author and others confirm the current acceptance of this concept. In addition, the Tax Court indicated its approval of gambling- session calculations in Shollenberger v. Commissioner of Internal Revenue. (T.C. Memo. 2009-306 (U.S. Tax Ct. 2009))

As guidance, Chief Counsel Advice Memorandum 2008-011 provides ten gambling- session examples. For example, if a taxpayer enters a casino with $100, and then at the end of the day redeems $300 worth of tokens, the IRS explains that the taxpayer has a wagering gain of $200 ($300–$100). Or stated another way, the $300 of proceeds less the $100 of basis results in a gain of $200. The IRS further states that “[t]his is true even though the taxpayer may have had $1,000 of winning spins and $700 in losing spins during the course of play.”

Another IRS example describes a taxpayer who enters the casino with $100 and loses the entire amount. The obvious result is a wagering loss of $100, “even though the casual gambler may have had winning spins of $1,000 and losing spins of $1,100 during the course of play.”

The IRS’s course-of-play statements have two major implications. First, the IRS recognizes the reality that a taxpayer may indeed “recycle” his gambling winnings during a single gambling session. For example, if a gambler starts the day with $10,000 in cash, and ends the day with $15,000 in cash but generates $100,000 of W-2Gs in the process, the taxpayer’s gambling winnings for the gambling session are $5,000—not the $100,000 of W-2Gs. In essence, a gambler who recycles his winnings is no different than a day trader who repeatedly buys and sells stocks or a real estate developer who flips houses.

Second, the IRS realizes that ignoring a gambling-session calculation penalizes the taxpayer by overstating the taxpayer’s adjusted gross income (AGI). For example, in the previous hypothetical, without a gambling-session calculation, the taxpayer is required to include $100,000 as gambling winnings as other income and deduct $95,000 of gambling losses on Schedule A. While this method results in the same amount of taxable income ($5,000), the taxpayer’s AGI is greatly inflated. Such an overstatement can easily penalize a taxpayer since AGI is used to calculate the phaseout levels for some deductions and as a multiplier for others.

To exacerbate the issue, several popular tax-preparation programs reviewed by the author ignore the gambling-session methodology as well; they merely total the W-2Gs. Such a limitation requires tax return preparers to alter, modify, override, or otherwise finesse their software so as to include all the individual W-2Gs and satisfy the IRS computer matching system, but simultaneously reduce other income by the amount of recycled gambling winnings so as to properly report the taxpayer’s AGI.

Step 4: Report Wagering Gains as Other Income, Wagering Losses as Other Miscellaneous Deductions

Gambling Winnings Reporting Requirements Rules

Once the result of each gambling session is determined, all the gambling sessions with wagering gains should be totaled together and included as “Other Income” on Form 1040. Next, if the taxpayer elects to itemize his deductions, all the gambling sessions with wagering losses should be totaled together and included on Schedule A (Itemized Deductions) as “other miscellaneous deductions not subject to the 2 percent limitation.” And don’t forget, the amount of the wagering losses may not exceed the amount of the wagering gains. If the taxpayer elects to take the standard deduction, the amount of wagering losses are ignored and not used. (Footnote 14)

Step 5: Prepare a Gambling-Session Analysis and Explanation for the IRS

IRS computers do a thorough job of matching amounts from documents submitted by third parties to the amounts reported on income tax returns. However, the IRS does not provide a gambling-session equivalent of Schedule D (Capital Gains and Losses), and IRS computers have not been programmed to process gambling- session calculations. Therefore, the tax preparer should consider completing a Form 8275 (Disclosure Statement), notifying the IRS that the gambling-session calculations were prepared in accordance with Chief Counsel Memorandum 2008-011 and Shollenberger v. Commissioner of Internal Revenue. Furthermore, a detailed analysis of each gambling session and a copy of any available gambling diaries should be included. By doing so, a manual review, if necessary, will permit the IRS to find and match up the Form W-2Gs reported under the taxpayer’s identification number.

Step 6: Review the Relevant State-Law Requirements

An often forgotten step is the treatment of gambling winnings and losses at the state level. While the number of state-level audits triggered due to gambling issues is almost nonexistent, a few basic issue-spotting pointers can help identify the major concerns in preparation of income tax returns for the various states.

Obviously, if the taxpayer resides in a state without an income tax, then the taxpayer won’t have to pay state income tax on his gambling income.

But what about amounts won by nonresidents in states that have an income tax? Initially, some states made it a point to aggressively pursue nonresident winners. Then, these states decided to automatically withhold state taxes from any winnings. (It is also important to remember that Native American gambling establishments are exempt from state withholding requirements.) This in turn may require the taxpayer to file nonresident returns in order to receive the appropriate refunds.

But then there is Mississippi. Mississippi automatically withholds three percent from everybody, and it is considered a nonrefundable income tax. Fortunately, it is not necessary to file a nonresident Mississippi income tax return since the documents provided by the casinos are considered to be the income tax return and proof that the tax was paid to Mississippi. Hopefully, the taxpayer’s state of residence will allow a credit for the tax paid to Mississippi.

For the most part, the majority of states follow the federal example of allowing gambling losses to be deducted. However, some states base their income taxes on the federal AGI. As such, these “above-the-line” states do not allow itemized deductions, including gambling losses. Currently, these states include: Connecticut, Illinois, Indiana, Louisiana, Massachusetts, Michigan, Ohio, West Virginia, and Wisconsin. The nonrecognition of itemized deductions, such as gambling losses, makes the gambling-session concept even more important to understand and implement.

As a word of warning, do not assume anything, and frequently research the status of the state laws. For example, many of the general principles discussed previously regarding state taxes are riddled with exceptions if the winnings are from various sources such as lotteries. Furthermore, the political winds can change quickly. As a case in point, in July 2009 the state of Hawaii eliminated the deduction for gambling losses. But on April 16, 2010, legislation was enacted to repeal the prohibition and make it retroactive to 2009. When in doubt, check it out.

Conclusion

It is very likely that gambling and casino entertainment will continue to grow. Now more than ever it is important for tax professionals to become better prepared and equipped to assist their clients in the evolving area of the tax law. Working together, taxpayers, tax professionals, and the IRS can help improve the accuracy, compliance, and understanding of the taxation of recreational gamblers. (Footnote 15)

To learn more about this topic, go to the NAEA webboard.

FOOTNOTES

1. IRC Sec. 165(d). “Losses from wagering transactions shall be allowed only to the extent of the gains from such transactions.” (The legislative history from the Revenue Act of 1934, Sec. 23(g), the predecessor of Sec. 165(d), used the terms “wagering” and “gambling” interchangeably.)

Gambling Winnings Reporting Requirements 2020

2. IRS Pub. 525, Taxable and Nontaxable Income, p. 31 (2012 Edition).

3. IRS Pub. 529, Miscellaneous Deductions, pp. 12–13 (2012 Ed.). The recordkeeping suggestions listed in this publication merely restate Sec. 3 of Rev. Proc. 77-29, 1977-2 C.B. 538, 1977 WL 42691 (IRS RPR).

4. IRC Sec. 61.

5. However, tax treaties provide the exception to this general rule. For example, the United States has a tax treaty with the Federal Republic of Germany that allows the exclusion of gambling income for German citizens. As such, German nonresident aliens are not subject to U.S. income tax. This fact was demonstrated in 2011 when Pius Heinz, a 22-year old professional poker player from Cologne, Germany, won the World Series of Poker. His $8.72 million winnings were tax free. Reportedly, he refused to take a check or wire transfer and insisted that his winnings be paid in cash.As a result of the large payout, the casino ran out of large denomination bills and eventually had to use $5 and$10 dollar bills in order to complete the transaction.

6. Rev. Rul. 54-339 (1954-2 C.B. 89).

7. Commissioner of Internal Revenue v. Glenshaw Glass Co., 348U. S. 426 (1955); Johnston v. Commissioner of Internal Revenue, 25 T.C. 106 (1955); Umstead v. Commissioner of Internal Revenue,T. C. Memo. 1982-573 (U.S. Tax Ct. 1982); and Commissioner of Internal Revenue v. Groetzinger, 480 U.S. 23 (1987).

8. Bauman v. Commissioner of Internal Revenue, T.C. Memo.1993-112 (U.S. Tax Court 1993). This mistake also resulted in penalties for negligence, failure to file, and failure to pay estimated taxes. The Court held that the tax deficiency was $20,384, and the penalties were $7,417.70— for a total of $27,801.70. In 1988, the only other income Mr. Bauman had totaled $10,574.

9. Carmack et ux. V. Commissioner of Internal Revenue, 183 F. 2d 1 (5th Cir. 1950); Norgaard v. Commissioner of Internal Revenue, 939 F.2d 87 (9th Cir. 1991); and LaPlante v. Commissioner of Internal Revenue, T.C. Memo. 2009-226 (U.S. Tax Ct. 2009).

10. United States v. Scholl, 166 F.3d 964 (9th Cir. 1999); and Shollenberger v. Commissioner of Internal Revenue, T.C. Memo. 2009-306 (U.S. Tax Ct. 2009).

11. Spencer v. Commissioner of Internal Revenue, T.C. Summ.Op. 2006-95 (U.S. Tax Ct. 2006) – a $2,525 deficiency; LaPlante v. Commissioner of Internal Revenue, T.C. Memo.2009-226 (U.S. Tax Ct. 2009)—a $1,808 deficiency; and Shollenberger v. Commissioner of Internal Revenue, T.C. Memo 2009-306 (U.S. Tax Ct. 2009)—a $555 deficiency.

12 Green v. Commissioner of Internal Revenue, 66 T.C. 538 (U.S. Tax Ct. 1976); and Szkirscak v. Commissioner of Internal Revenue, T.C. Memo. 1980-129 (U.S. Tax Ct. 1980).

13. Commissioner of Internal Revenue v. Glenshaw Glass Co., 348 U. S. 426 (1955).

14. Johnston v. Commissioner of Internal Revenue, 25 T.C. 106 (U.S. Tax Ct. 1955); and Shollenberger v. Commissioner of Internal Revenue, T.C. Memo. 2009-306 (U.S. Tax Ct. 2009).

15. Gamblers are typically described as “recreational” or “professional.” Recreational gamblers must separately compute and report their gambling winnings and gambling losses as described in this article. On the other hand, professional gamblers are allowed to compute and report their gambling winnings and gambling losses on Schedule C. Such treatment allows the professional gambler to avoid inflation of his or her adjusted gross income (AGI). Throughout tax literature, the terms “recreational” and “casual” are used interchangeably to describe a non-professional gambler.

This article was previously published in the March/April 2012 edition the EA Journal, a publication of the National Association of Enrolled Agents. Online reprints of the article are available HERE and HERE.

Related Posts

With the growth of gambling in Oklahoma, many industries have rushed to provide the needed…

The government is spending billions to fund assisted living services through Medicaid, but government oversight…

Gamblers love to use casino win/loss statements because it is easy. Just report the amounts…

The reason why the IRS loves gamblers to use a gambling diary is obvious. A…

Losses from wagering transactions shall be allowed only to the extent of the gains from…

The 17 words of Internal Revenue Code Section 165(d) provide little guidance on the reporting…

Professional gamblers are treated differently from amateur gamblers for tax purposes because a professional gambler is viewed as engaged in the trade or business of gambling. The professional gambler reports gambling winnings and losses for federal purposes on Schedule C, Profit or Loss From Business. To compute his or her business income, the professional gambler may net all wagering activity but cannot report an overall wagering loss. In addition, the taxpayer may deduct 'ordinary and necessary' business expenses (expenses other than wagers) incurred in connection with the business.

Whether a gambler is an amateur or a professional for tax purposes is based on the 'facts and circumstances.' In Groetzinger, 480 U.S. 23 (1987), the Supreme Court established the professional gambler standard: 'If one's gambling activity is pursued full time, in good faith, and with regularity, to the production of income for a livelihood, and is not a mere hobby, it is a trade or business.' The burden is on the gambler to prove this status.

In addition to applying the standard established in Groetzinger, courts sometimes apply the following nonexhaustive nine-factor test in Regs. Sec. 1.183-2(b)(1) used to determine intent to make a profit under the hobby loss rules to decide whether a taxpayer is a professional gambler:

- The manner in which the taxpayer carries on the activity;

- The expertise of the taxpayer or his advisers;

- The time and effort the taxpayer expended in carrying on the activity;

- An expectation that assets used in the activity may appreciate in value;

- The taxpayer's success in carrying on other similar or dissimilar activities;

- The taxpayer's history of income or losses with respect to the activity;

- The amount of occasional profits, if any, that are earned;

- The financial status of the taxpayer; and

- Elements of personal pleasure or recreation.

What if a professional gambler's 'ordinary and necessary' business expenses exceed the net gambling winnings for the year? In Mayo, 136 T.C. 81 (2011), the court held the limitation on deducting gambling losses does not apply to ordinary and necessary business expenses incurred in connection with the trade or business of gambling. Therefore, a professional gambler may report a business loss, which may be applied against other income from the year.

LIMITATIONS ON LOSS DEDUCTIONS

Some states do not permit amateur gamblers to deduct gambling losses as an itemized deduction at all. These states include Connecticut, Illinois, Indiana, Kansas, Massachusetts, Michigan, North Carolina, Ohio, Rhode Island, West Virginia, and Wisconsin. A taxpayer who has $50,000 of gambling winnings and $50,000 of gambling losses in Wisconsin for a tax year, for example, must pay Wisconsin income tax on the $50,000 of gambling winnings despite breaking even from gambling for the year.

Because professional gamblers may deduct gambling losses for state income tax purposes, some state tax agencies aggressively challenge a taxpayer's professional gambler status. A taxpayer whose professional gambler status is disallowed could face a particularly egregious state income tax deficiency if the taxpayer reported on Schedule C the total of Forms W-2G, Certain Gambling Winnings, instead of using the session method under Notice 2015-21. In this situation, the state may be willing to consider adjusting the assessment based on the session method if the taxpayer provides sufficient documentation.

For a detailed discussion of the issues in this area, see 'Tax Clinic: Taxation of Gambling,' by Brad Polizzano, J.D., LL.M., in the October 2016 issue of The Tax Adviser.

—Alistair M. Nevius, editor-in-chief, The Tax Adviser

The Tax Adviser is the AICPA's monthly journal of tax planning, trends, and techniques.

Also in the October issue:

- An analysis of executive compensation clawbacks.

- An update on recent developments in estate planning.

- A look at revisions to Forms 1042-S and W-8BEN-E.

AICPA members can subscribe to The Tax Adviser for a discounted price of $85 per year. Tax Section members can subscribe for a discounted price of $30 per year.